register your company in estonia: 10 useful things to know

A guest post by Unicount with answers to common questions e-residents have after registering an EU company in Estonia

1. Your company’s registration certificate is available online for free

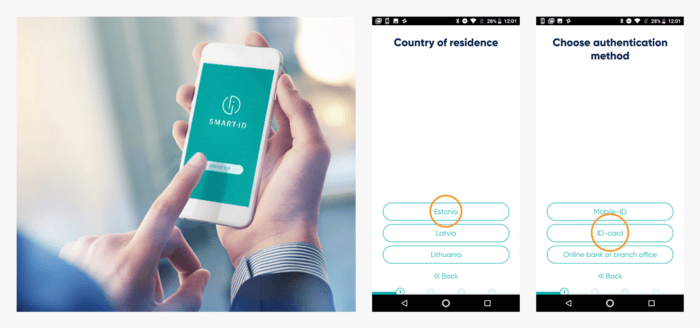

2. You can use Smart-ID on your phone to log in and sign

3. Protect your personal contact details from scraping sites

4. There is no company tax ID or alternative trading name in Estonia

This also means that you do not need to apply for any tax number to start trading in Estonia.

5. You can register for VAT in Estonia only when necessary

6. Your main activity code does not really limit your business scope

7. Annual report needs to be submitted even if the company was dormant

8. You can add new shareholders and investors online

Luckily by now there are four alternative ways to add new shareholders.

The first method is using an e-notary, which was launched in February 2021.

Managing your own shareholder list

Using NASDAQ depository service

Issue new shares of your Estonian company online

9. No need to register share capital immediately if you do not plan dividends

10. You need to keep your expense documents for accounting

In some countries your accountant might be ok with bank statements only.

Not in Estonia.

And finally…

Thanks for reading

More from e-Residency

- Sign up for our newsletter

- Watch fresh video content - subscribe to our Youtube channel

- Meet our team and e-residents - register for our next Live Q&A