estonia’s tax system most competitive in the world

For the tenth year in a row, Estonia is first in International Tax Competitiveness. And despite changes to its tax rules and rates next year, it’s likely it will stay that way.

Editor's Note (April 2025): Estonia increased tax rates for companies and individuals on 1 January 2025. A security tax package has also been introduced, which will raise the VAT rate from 1 July 2025 and raise the personal tax rate from 2026. Read more about the changes.

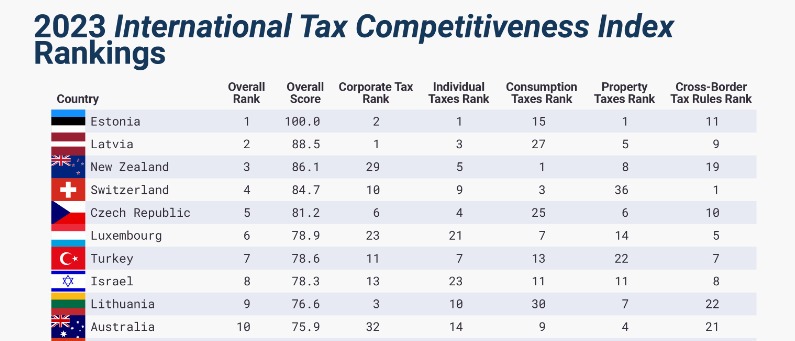

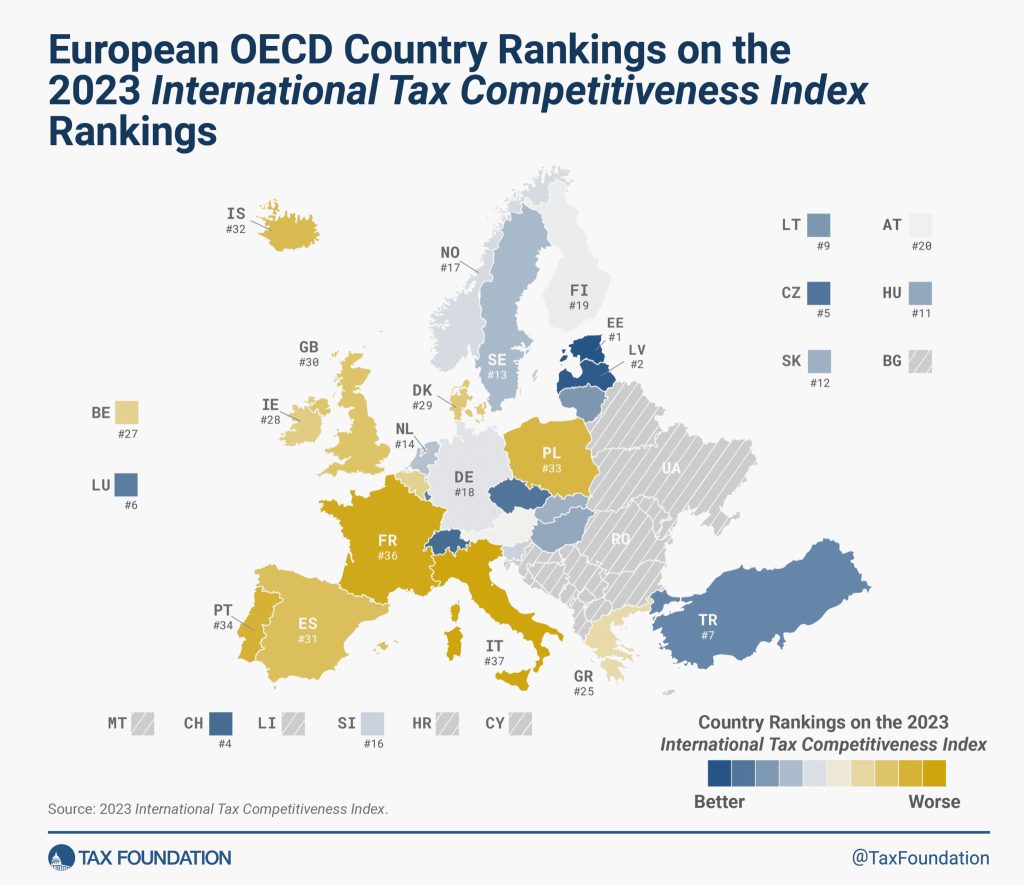

For the tenth year in a row, Estonia's tax system has topped the 2023 International Tax Competitiveness Index (ICTI). This means that once again, Estonia has the best tax code of all OECD countries.

A well-structured tax code is a good determining factor of a country’s economic performance. Taxpayers can more easily comply with a properly structured tax code and thus promote economic development, which in turn improves the country’s public revenues. On the contrary, poorly structured tax systems “can be costly, distort economic decision-making, and harm domestic economies”. So says the Tax Foundation, the US-based tax policy non-profit and publisher of the ICTI.

OECD countries approach taxation in a variety of ways, resulting in a need for comparison to critically evaluate performance. For that purpose, the Tax Foundation developed the ITCI. The ITCI looks at more than 40 tax policy variables to measure the competitiveness and neutrality of country tax codes. These include tax rates and structures of a country's corporate taxes, individual income taxes, consumption taxes, property taxes, as well as the treatment of profits earned overseas.

Estonia's top score in 2023 is again driven by four features of its tax system:

- a cash-flow corporate tax system with a 22% tax rate only applied to distributed corporate profits

- a flat 22% tax on individual income that does not apply to personal dividend income (an additional 2% will be taxed on individuals from 2026)

- property tax applies only to the value of land, rather than to the value of real property or capital, and

- Estonia's double tax treaty network helps domestic corporations get credits for foreign tax liabilities.

And just as Estonian citizens and tax residents benefit, so too can e-residents. While Estonia is not a tax haven and e-Residency doesn’t exempt you or your companies from dual tax residency or foreign tax liabilities, Estonia's clear tax system and network of 62 tax treaties can be a huge advantage for foreign entrepreneurs looking for a place to base their borderless business. This includes opportunities to take advantage of the country's clear tax system, transparent business environment, and efficient digital services. Together, these features keep compliance efforts and costs low and the time to file taxes at a minimum.

E-residents can take further steps to make their companies tax residents of Estonia. This will involve structuring your corporate operations to ensure more business presence in Estonia. For example, renting an office or site location, hiring employees, registering assets or intellectual property, and holding board meetings in Estonia.

We recommend speaking to a tax expert to get advice on international conventions, the tax codes of Estonia. They can also help you optimise your corporate tax structure taking into account your own geographical location and business operations.

To browse expert international and country-specific tax advisers, visit the e-Residency Marketplace.

Looking forward to 2024-26 and changes to Estonian taxes

This year, the Estonian Government announced amendments to Estonian tax law. The changes will come into force between 2024 and 2025. The adopted amendments concern increased tax rates and elimination of some exemptions. Generally speaking, the overall tax system in Estonia will remain simple and transparent.

The main changes affecting e-resident businesses are listed below. To help prepare e-residents for these changes and their implications for your businesses, we will be providing more information on their specifics in the coming months.

From 1 January 2024:

- The standard Value Added Tax (VAT) rate increased to 22%. The change only impacts e-resident businesses selling to consumers in Estonia. For these businesses, the change might necessitate a re-evaluation of prices on supplies.

From 1 January 2025:

- The standard Corporate Income Tax (CIT) rate increased to 22%, i.e., 22/78 on net distributions. This means that companies are subject to a higher tax cost for profit distributions.

- The 14% reduced CIT rate was abolished. The 14% CIT rate currently applies to regularly paid dividends. As a result, the 7% withholding Personal Income Tax (PIT) no longer applies (except for any dividends already taxed before 31 December 2024 at the CIT rate of 14/86).

- The PIT rate will increased to 22% and the regressive tax-free income for natural persons was replaced with uniform tax-free income of 700 euros per month. The rise in PIT could lead to a potential decrease in net salaries and wage pressure, and could impact e-resident businesses. However, Estonia’s simple, flat PIT system remains advantageous over most countries that apply progressive PIT.

You can find all proposed changes and read more specifics on the Estonian Tax and Customs Board website.

Importantly, there will be no introduction of capital gains tax or property transfer taxes. And property tax will continue to only apply to the value of land (not buildings). Due to this and the continued simplicity and efficiency of Estonia’s tax code, most likely, we will remain number one in international tax competitiveness and neutrality in the OECD.

Security tax package

The Estonian Government has also introduced a ‘security tax’ package. The original package contained three elements, which were planned to last until 31 December 2028. However, since making the law, the Estonian Government has decided to remove the corporate profit tax and to make the increased VAT rate a permanent change. The legislative process to implement these changes to the package will start in May. We'll update our community once the legislative process is underway. The three original elements of the package were as follows:

- Element 1 (to be removed): 2% tax on corporate profit – this element will be removed from the law in a legislative starting in May 2025

- Element 2: Increase in the VAT rate by 2% to 24% - this element will commence on 1 July 2025 and stay for good. VAT-registered e-resident companies will need to start using this rate from that date.

- Element 3: Additional personal income tax of 2% - this element will commence on 1 January 2026. E-resident companies with employees in Estonia should note the additional 2% personal income tax from 1 January 2026. This additional personal income tax will also apply to the salaries of board members of companies, from 1 January 2026. This 2% additional personal tax differs as it will be applied to gross income with no deductions (unlike standard personal income tax). For the vast majority of e-residents, you will continue paying personal taxes in your own country of tax residency at its local rates, so the change in Estonia's personal income tax rate will not impact you.

More from e-Residency

- Sign up for our newsletter

- Watch fresh video content - subscribe to our Youtube channel

- Meet our team and e-residents - register for our next Live Q&A