e-Residency and dubai virtual commercial city

A comparison of two innovative digital business environments in Estonia and Dubai

Technology and digitalization are the keystones of modern government policies. Many countries are starting to digitalize their services and adopt new ways of doing things, at an ever-increasing rate. In this article, we will look at two different types of digital business environments and how they compare, Estonia’s e-Residency, and Dubai’s Virtual Commercial City (VCC).

The United Arab Emirates (the “UAE”) and Estonia have strong ties and a rapidly developing relationship. Enterprise Estonia opened its first office in the UAE in 2019, which was followed by the opening of the Estonian Embassy in early 2021. Estonia and the UAE also jointly hosted a Virtual Global Business Summit in 2020 and they continue to share expertise in the development of both their business environments. This can be seen in the examples displayed at the Estonian Pavilion at the Dubai Expo 2020, where more than 40 enterprises are represented to demonstrate how Estonia has achieved a modern information society, one of which is the e-Residency program.

As we are looking at some of the legal aspects of Dubai, it is important to highlight that UAE is made up of 7 emirates that are separately governed. Though there are a number of federal laws and regulations that affect all 7 emirates, in this article, we will focus on the emirate of Dubai and the VCC program.

What are e-Residency and Dubai Virtual Commercial City?

Both programs offer access to the local business environment by non-residents but in different ways. Estonia provides access in the same way Estonian residents have - digitally via an electronic ID - with most government services already online. While Dubai provides a business licence and a bespoke set of service providers that enable you to do business in the Emirate via a specialised portal. Before looking at their differences let’s look more at each system individually.

e-Residency

The e-Residency program provides a government-issued digital identity, which allows full access to Estonia’s e-services and transparent business environment. E-Residency allows digital entrepreneurs to establish and manage an EU-based company completely online, from anywhere in the world. A successful application provides an individual with a digital ID card through which they can access all the same government e-services as an Estonian citizen or resident, as well as many private services such as business banking, virtual office, and automated or delegated accounting services.

Dubai Virtual Commercial City

Dubai Virtual Commercial City program (VCC) provides an ecosystem for legitimate global entrepreneurs regardless of where they reside. The VCC program offers a Virtual Company License, business registration, access to a regulated e-commerce platform DubaiStore.com and facilitation to access banking services. The Virtual Company License provides access to digital infrastructure and approved service providers.

Structural Differences

Estonia and Dubai, have distinct structural differences in how their legal and business environments operate. The majority of economic activities in the UAE require commercial licenses which need to be renewed on a periodical basis. Though these licenses, such as the one required to run a Virtual Company, are not generally difficult to obtain, this differs from Estonia which only requires licenses for a small category of regulated activities. In Estonia, normal company operation does not require renewed permission once incorporation has occurred. By its nature this makes having a presence in the UAE sometimes a transitory experience, requiring you to keep ongoing and good relations with the government in order to operate. But this also means it is easy to wind up your company if you wish to close it. Such a process in Estonia can take 6 months no matter the size of the company.

The second-largest difference between the VCC program and e-Residency is that Dubai’s program is limited to select countries where e-Residency welcomes applications from all countries. A successful application to the VCC automatically incorporates a company that is limited in its activities to the defined fields of the program. A successful application to the e-Residency program does not limit your area of economic activity and also gives you a digital identity with which you can interact in all Estonian legal and business environments. The VCC also limits its companies to have a single shareholder where e-Residency does not. In fact, one of the great benefits of opening an OÜ or private limited company in Estonia is the ability to do so with multiple founding shareholders, who can be e-residents, Estonian nationals, or certain other EU nationals with compatible e-ID cards.

Though both of these programs enable the virtual running of resident businesses by non-residents, their nature as a product is fundamentally different.

A Comparison

Now we have examined the structural difference, let’s compare the different features each program has.

Application Requirements

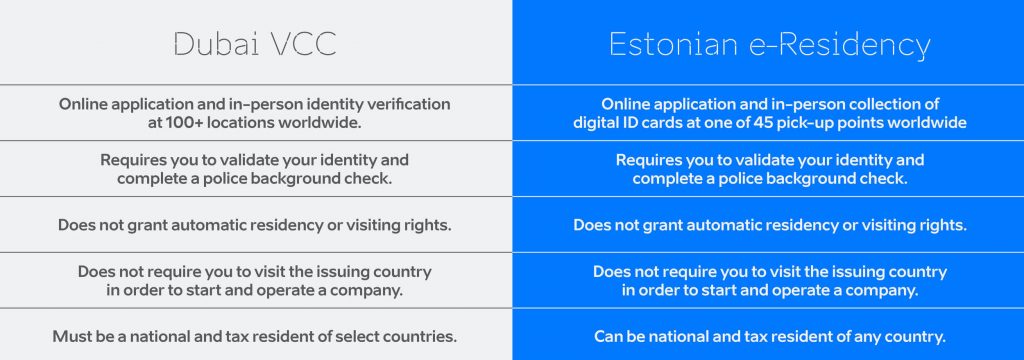

You can apply for both programs online. Applications are subject to police background checks and require applicants to authenticate their identity in-person (although this doesn't need to be in the issuing country). Neither the VCC nor e-Residency grant any rights of travel or residency to Dubai or Estonia respectfully. The major difference here is that Estonian e-Residency is open to nationals of any countries, whereas Dubai only grants the VCC to nationals and tax residents of a select list of countries. The following table illustrates the similarities and differences in application requirements:

Operations

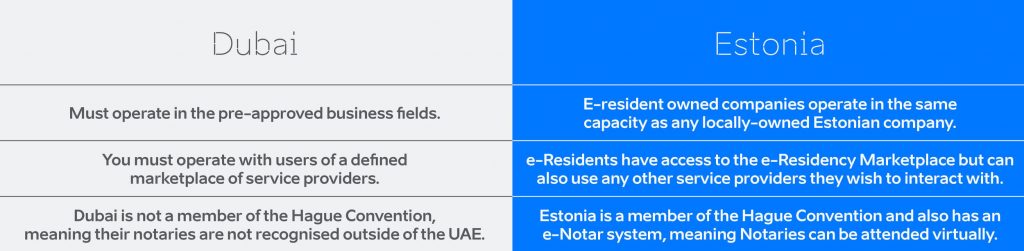

An e-resident owned company operates in the same capacity as locally-owned Estonian businesses and can operate in any field of activity. In contrast, VCC holders must operate in pre-approved business fields. There are marketplaces of business service providers available to support both VCC holders or e-residents, but here e-residents have more flexibility in which service providers they are permitted to use as they are not bound to the e-Residency Marketplace members. And, unlike Dubai, Estonia is a member of the Hague Convention - which means Estonian notaries are recognised outside of the country. Furthermore, Estonia last year launched an e-Notary system, meaning notaries can be attended virtually. The following table contrasts the operational aspects of Dubai and Estonia for foreign-owned businesses:

Taxation

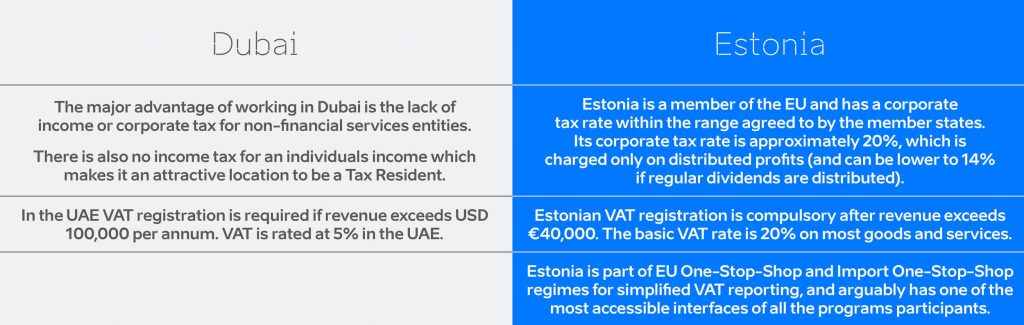

Dubai has tax advantages in that there are no income or corporate taxes for non-financial service entities, and no income taxes for individuals. Estonia's corporate tax rate is 20% on distributed profits, which can lower to 14% if regular dividends are distributed.

VAT registration is required in Dubai when revenue exceeds USD100,000 and the rate is 5%. In Estonia, VAT registration is required above €40,000 revenue and in most cases, the rate is 20%. Estonia is part of the EU's One-Stop-Shop and Import One-Stop-Shop regimes for simplified VAT reporting. Couple this with Estonia's fast and easy online tax system, and it arguably has the most accessible and simplified tax reporting interface in the EU. The table below compares the tax differences between the two jurisdications:

Trading proximity

Both Dubai and Estonia are good locations to do business between Western and Eastern markets. In the case of Dubai, with a particular focus on the Middle East and sharia law-compliant financing models and the benefit of its business airport hub for travellers across the world. Whereas Estonia can be seen as a perfect entry point to the EU for entrepreneurs wanting to access the Single Market, or build a startup in a stable, business-friendly commercial environment. The following table compares the trading proximity of each jurisdiction in more detail:

Where should you set up your next company?

Both countries have their benefits and weaknesses, but ultimately the nature of your business will probably guide your decision. If you are looking to sell to the European Union or import services or goods to a country in the EU, Estonia is an ideal place to establish a company and set up an office to fulfil that functionality. If you are looking to dropship within the UAE or provide services in South East Asia or the Middle East, Dubai could be a suitable jurisdiction to work from.

Before setting up any company it is important to understand what your requirements are both logistically and legally. Depending on your resident countries tax residency rules, opening a company in either Dubai or Estonia could lead to your company being treated the same as one in your resident country. Please have a read of our Permanent Establishment and Transfer Pricing articles if you are interested in learning more.

Alan Page-Duffy is a freelance writer for e-Residency. He specializes in UK / Estonian Business Operations and runs his own consultancy Cognito Support which supports businesses that operate in both Estonia and the UK.