from geoarbitrage to digital arbitrage?

Thanks to Estonian e-Residency and other initiatives, entrepreneurs now have even more choice about where to live, work and do business - welcome to the world of 'digital arbitrage'

In today's globalised world, opportunities for entrepreneurs to build and grow their businesses are more abundant than ever. We are certainly no longer constrained to live and work in the place we randomly happened to be born. But with the world at our feet, how do we begin to choose where that will be? The world is a big place!

Many location-independent professionals are experts at leveraging geoarbitrage, to upgrade their lifestyles.

But what exactly is geoarbitrage? And could our new virtually-connected world open up a new layer of possibilities - digital arbitrage? In this article, we'll explore some of the top factors you should consider when optimising digital and geoarbitrage for your businesses.

Definition of Geoarbitrage

In essence:

Geoarbitrage means taking advantage of the decoupling of your life and work from a specific location, in order to make your income go further.

It may be as simple as moving out of expensive urban commuter belts to a rural location or smaller town, where you can enjoy better accommodation for the same cost. Or it may mean earning in a strong currency and spending in a weaker one, by relocating to another country, or travelling the world. In business terms, it might involve outsourcing work to countries with lower labour or service costs to make your business income go further.

Geoarbitrage as a concept has been around for a while, ever since it was coined by Tim Ferriss in his 2009 book The 4-Hour Workweek.

Since then, the world has become more digital. This is thanks to faster communications technologies, globalisation of online marketplaces, and the development of user-focused collaborative tools. People, companies, and even countries have embraced the virtual world for business, entertainment, news, and community. Today’s unique collaboration climate means that savvy entrepreneurs - from solos to multinationals - can go one step further, and unlock the power of true 'digital arbitrage'.

Definition of Digital arbitrage

Digital arbitrage is similar to geoarbitrage, but involves leveraging online initiatives and systems to make better finance, lifestyle and even business choices.

Beyond simple currency and tradeoffs, today we can take into account different countries' economic climates, tax systems, regulatory infrastructure, and other factors, to maximise profits and minimise costs. Combining all this with personal preferences and lifestyle choices, every person can create a work-life style that uniquely suits them.

Below, we'll explore some of the top factors you should consider when optimising digital arbitrage for your businesses. The aim is to help you develop a framework for big decisions in your own life if applicable. And of course, we will explore how Estonian e-Residency can support that choice, and even make it possible in the first place.

Factors to consider when optimising digital arbitrage for your business

1. Digital Infrastructure

In these days of widespread fibre broadband and mobile network coverage, it’s easy to take being able to get online–often with uncapped data allowances–for granted.

In fact, it has almost become what psychologist Herzberg defined as a hygiene factor: something you only really notice if it’s missing, while not realistically appreciating in scale. There’s not that much more you can do with a 600 Mbps internet connection than you could with a solid 60Mbps one. But for the average knowledge worker or team lead, if you lose connection for an hour, you definitely notice. You’re probably unable to do anything.

Choosing a location with a robust digital infrastructure really matters, and that includes backup plans. There are parts of the world where most high-speed internet depends on a single undersea cable, or where the mobile network coverage gives you no plan B if anything happens.

But digital arbitrage is not just about getting online. You also need adequate digital infrastructure to operate your business effectively.

Estonia's secure and trustworthy digital business environment

Secure and trustworthy digital business infrastructure is one reason so many entrepreneurs choose Estonian e-Residency for their business operations.

Becoming an e-resident gives entrepreneurs immediate access to the governmental and financial infrastructure of e-Estonia, from anywhere in the world.

This means you can easily form and operate your business in Estonia regardless of your physical location. So, you can have your company in Estonia but choose to live elsewhere. As well as adding flexibility and choice to your lifestyle, e-Residency also won’t affect your personal tax residency.

While other countries are increasingly learning from Estonia’s example in digital transformation, few are anywhere near as advanced. Plus, when it comes to business operations in particular, it’s important to compare countries carefully.

2. Ease of Doing Business

Comparing digital ease of doing business is part of a bigger picture even than digital infrastructure. On or offline, the mechanics of setting up a new company vary significantly, not to mention business regulations, or day-to-day operational overheads.

As the old saying goes, time is money! And time doing admin, complying with bureaucratic rules, or trying to get your accounting software to sync with the local tax office, is time you aren't spending on fee-earning activities.

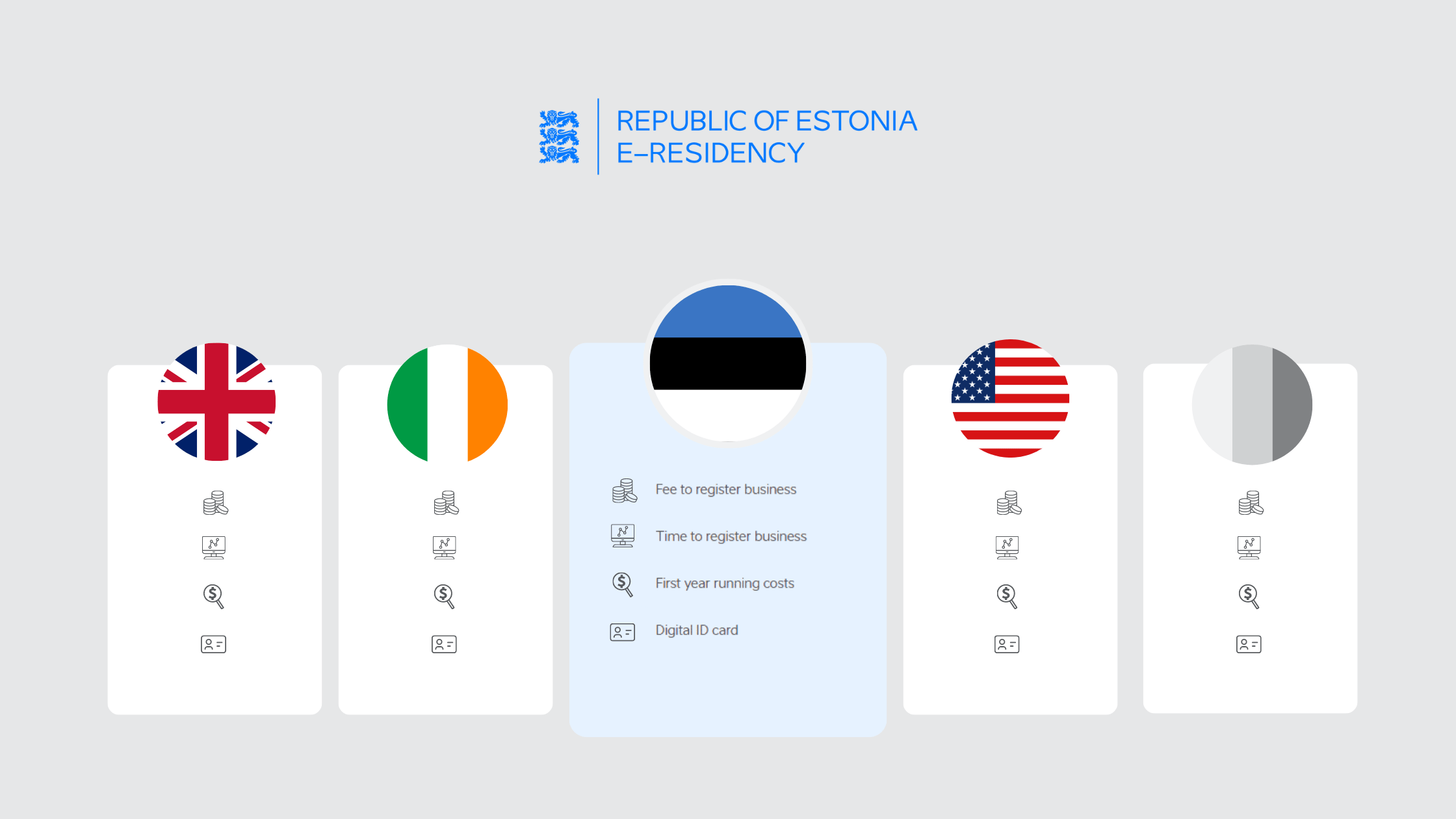

Compare company formation across different countries

You can form a new company in Estonia in less than a day once you hold an e-Residency card (in fact, the record is measured in minutes.) This would not be possible without the advanced digital infrastructure discussed above.

But e-Residency has one big advantage over its competitors in digital leverage impact. While there are many other countries also with a great ease of doing business (such as Singapore), they require foreigners to have local business partners on their board. Delaware in the US is famed for its business flexibility, yet requires a local agent. Ireland - globally renowned for its startup-friendly tax codes - similarly needs an EU national as a founder.

Compare business management across different countries

The range of business services needed to operate any company are digitally integrated to different extents, which also has a significant bearing on ease of operation. In Estonia, a single digital signature offers access to banks, accountants, and countless other services, in addition to government tools such as taxation and local funding. This helps to explain why Estonia’s first year running costs compare so favourably to other nations (by a factor of 10, in the case of both Ireland and Delaware, incidentally.)

Language too can impact on business ease, and Estonia’s digital services are available in fully native English (as well as Russian, and of course, Estonian.) This should not make a huge difference in a world of modern in-browser translations, however when it comes to legal and statutory information it’s worth remembering that this can sometimes be challenging to parse even in one’s native tongue. Once it’s been through automated translation never intended for use on legalese, it can be spectacularly mangled. So it is useful if you can access all the regulatory and official documentation you need, in a language with which you are fluent and familiar.

It’s also useful to choose, if you can, a culture and environment which supports and celebrates the kind of business you intend to create. Estonia’s reputation as a minimal-regulation, pro-innovation business environment is a big plus in this regard.

3. Addressable market

Where are your customers, and if applicable, where are your products? What is required to connect one with the other?

If your product or service is purely digital, this may not be a significant consideration, at least provided you are okay with sanctions imposed by bodies like the UN security council and the EU. That still leaves a pretty large global marketplace for you to do business with.

So while you may be able to register a business more cheaply elsewhere (such as in the UK for £12), you do need to consider the legal location of your entity as a trading partner.

If your product or service is physical, fragile, or requires complex logistics (like cold supply chain), or in-person services like training, then the local market becomes an important arbitrage factor.

For example, Estonia’s local market is small, at around 1.3 million people. Estonia is a member of the EU and Eurozone, cementing it as a secure and accessible place to do business. Regardless of citizenship and residency, e-resident companies have access to the European Economic Area (EEA), the world's largest trading bloc and single market, and can easily trade in euros. That access is valuable to all non-EU founders. For instance, while UK residents and citizens may have a much simpler time registering a company in the UK, access to the EU market is a serious hurdle since Brexit.

4. Currency conversions and the rise of fintechs

One classic area for traditional geoarbitrage is leveraging currency conversions, especially in the truly location-independent space. If you don’t need to be in a big expensive city to access customers or resources, why not earn money at big-city rates, and spend small-southern-village costs of living?

In recent years, this concept has also been taken up by financial technology companies (or so-called ‘fintechs’). These companies are bridging the gap between what traditional banks offer and what customers are now wanting. Fintechs often provide lower fees for currency conversions and international transactions than traditional banks and currency converters. Along with their truly virtual nature, they provide a digital alternative for both personal and business banking, which can save costs, time, and paperwork.

Leveraging currency and cheaper banking is definitely an attractive idea. It’s one which many Estonian e-residents leverage effectively. Their home of choice might not itself score highly on factors like ease of doing business or digital infrastructure, but provided you can reliably connect to it from that pacific island beach hammock or similar, you’re golden!

5. Tax optimisation

Tax optimisation is when people lower the amount of their tax liability while still complying with the tax obligations in force in their country of tax residency. Essentially, it's about using tax regulations to the taxpayer's advantage. It is THE classic topic for arbitraging.

Tax Residency

For many people, tax rates and rules are huge considerations when it comes to choosing where to live and be a tax resident. There are also people who arrange their lives in order to be tax resident nowhere at all.

It’s because the rules around taxes and tax residency are inconsistent around the world, that this can be arbitraged. There are countries which have no personal income taxes, like Bermuda, the Bahamas, and UAE. However, obtaining residency in one of these spots may be costly. For example, the European enclave of Monaco is income tax-free. But, to obtain a legal residence permit in 3 months, you must deposit at least half a million euros in a Monaco bank.

Expatriation Taxes

Tax residency is not the only factor affecting your personal liability. US citizens living anywhere are legally obliged to declare US income taxes every year. The US has also imposed an expatriation tax, which makes renouncing citizenship a costly exercise for anyone of high net worth. Furthermore, countries define tax residency differently. It’s not as simple as staying under 183 days, but rather involves other factors like property ownership, family, and business connections.

Living in an increasingly digitised and interconnected world makes it harder to drift around the world without any financial footprints. The Foreign Account Tax Compliance Act (FATCA) is a US law that forces non-US banks to provide the IRS with information about their US customers, and the Common Reporting Standard (CRS) is a global reporting standard that allows tax authorities from multiple countries to access information about their citizens’ finances. It will be no surprise that banks and governments really aren’t keen on people who say ‘they don’t live anywhere’. If this is your position, expect significant scrutiny of your affairs. Don’t say we didn’t warn you!

Creating a legal tax optimisation structure

To optimise taxes (as opposed to avoiding or evading taxes) on a global scale, most people therefore need to create some kind of structure that works legally. This usually requires a personal tax residence somewhere where they actually spend time and manage their affairs for most of the year. Otherwise, things like opening bank accounts and accessing local services become extremely difficult.

On the upside, the above-mentioned reporting standards have enabled a network of double taxation agreements. These often mean you don’t pay tax on the same income or gains twice. Generally speaking, it is well worth paying for quality specialised professional advice (ideally advice that is indemnified in the place you live) to make the most of the challenges and opportunities on offer.

E-Residency of Estonia and international taxation

So, how does Estonian e-Residency fit into the tax arbitrage picture?

Generally speaking, it does not.

E-Residency is unrelated to tax residency, and it is only your business which is resident in Estonia. If you don’t pay dividends from it, you may end up paying no Estonian tax at all. Plus, e-Residency will not exempt you from foreign tax liabilities in your country of residence. These will arise if your local tax authority considers your company to be effectively managed there, or its activities to create a permanent establishment.

Read more about e-Residency and cross-border taxation here.

Indeed, Estonia is not a tax haven. It is the number one place in the OECD for tax competitiveness, but this is largely due to the data-driven transparency and digitisation of the system, and the efficiencies this creates.

However, many people who want to leverage location-independence as part of their tax optimisation strategy, or simply enjoy travelling and living in different places at different times, find it very useful to keep their business located in one place while they do so. This saves on time (which equals money) by reducing administration and regulation costs, and may also help to smooth and manage personal income as well.

By paying yourself from your Estonian entity at tactically timed intervals you may avoid crossing a local income tax threshold, for example. However, you may need to also consider the risks of accumulating wealth in an overseas entity, if you live somewhere which taxes you on your global income.

In short… 1. Estonia is not a tax haven, and 2. You need qualified, local, individual advice! Which this article cannot claim to offer.

Instead, head to the e-Residency Marketplace to find a variety of tax advisers from around the world.

The world is at your feet – so choose well!

As you can see, there are a great many factors you can optimise for. From taxes to digital ease, optimising and arbitraging where you live and work will require research and speaking with experts.

Most of these choices are not set in stone, and depending on the power of your passport among other things, you can usually opt to go somewhere else if your chosen combination is not working. However, doing so can be costly in different ways, and most people prefer not to be constantly on the move and looking over their shoulder for the tax man, nor trying to figure out the best way to constitute and operate a business in a brand-new system on a regular basis.

An Estonian e-resident founded business can be created and run from anywhere on the planet. Thus, e-Residency is a useful tool in your digital arbitrage toolbox. It unlocks a world of possibilities for you personally to explore and experiment. All while your business operation stays conveniently in one digital, transparent, competitive, and connected spot, for minimum admin and hassle.

In the bold new world of work, the choice is yours to make!

More from e-Residency

- Sign up for our newsletter

- Watch fresh video content - subscribe to our Youtube channel

- Meet our team and e-residents - register for our next Live Q&A