how a company’s legal address and official contact person raise business credibility in estonia

Why does your legal address matter?

Therefore, it is essential to weigh your options in terms of operational convenience, customers, and legal requirements.

One legal requirement for a foreign address

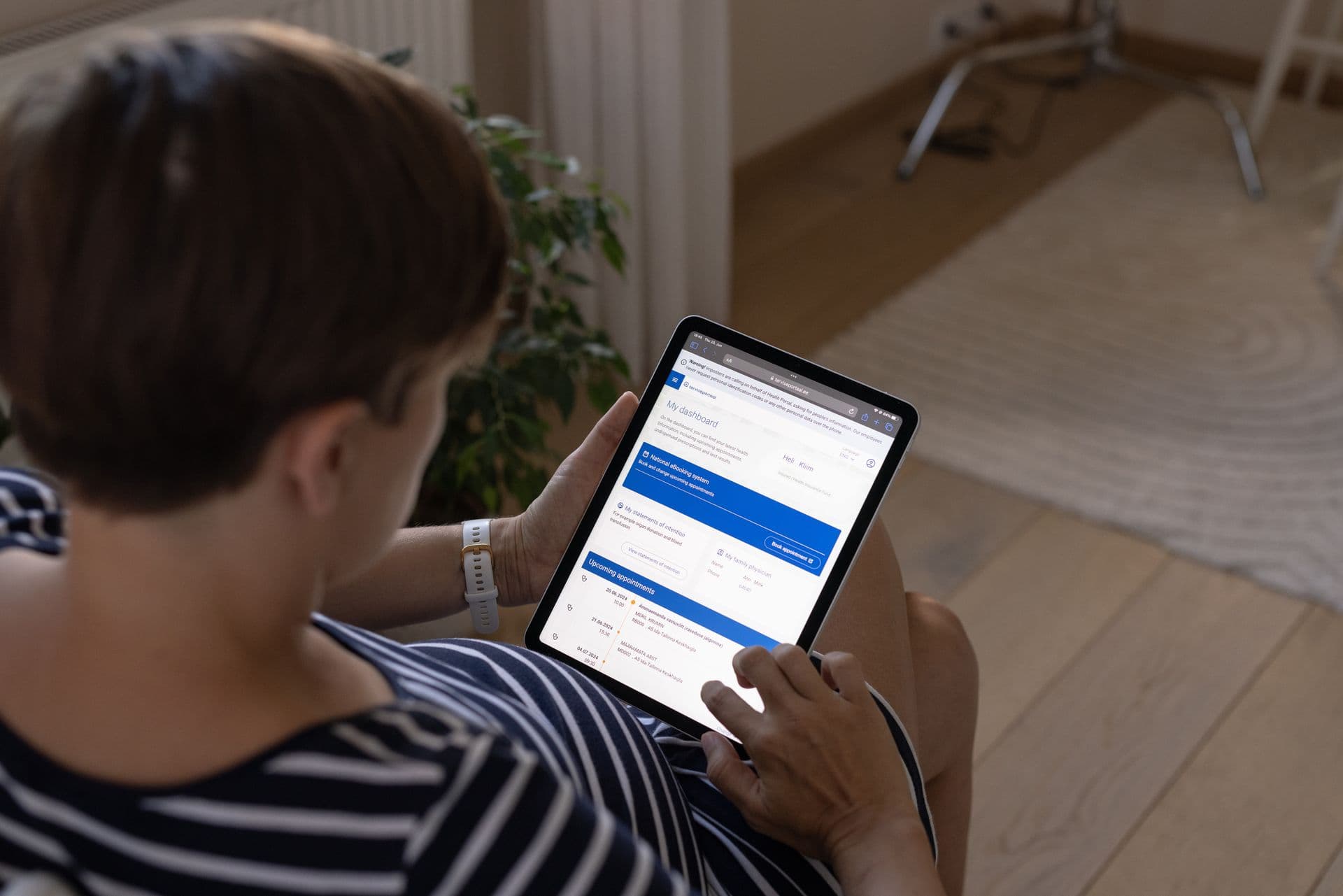

If your company's legal address isn’t in Estonia, you are required by law to appoint an official and local contact person for your Estonian company.

Reputation, trust, and compliance go together

helps your business earn trust from banks, clients, and partners alike.

More from e-Residency

- Sign up for our newsletter

- Watch fresh video content - subscribe to our Youtube channel

- Meet our team and e-residents - register for our next Live Q&A