why it insurance is essential for global entrepreneurs

What do e-resident founders need to be aware of about cybersecurity in 2025? How can they safeguard their businesses with IT Insurance?

IIZI's Helen Evert underscores the misconception that general business insurance includes cyber protection:

More from e-Residency

- Sign up for our newsletter

- Watch fresh video content - subscribe to our Youtube channel

- Meet our team and e-residents - register for our next Live Q&A

Read next

5 things that your accountant is not telling you

What to look for in a professional liquidation service?

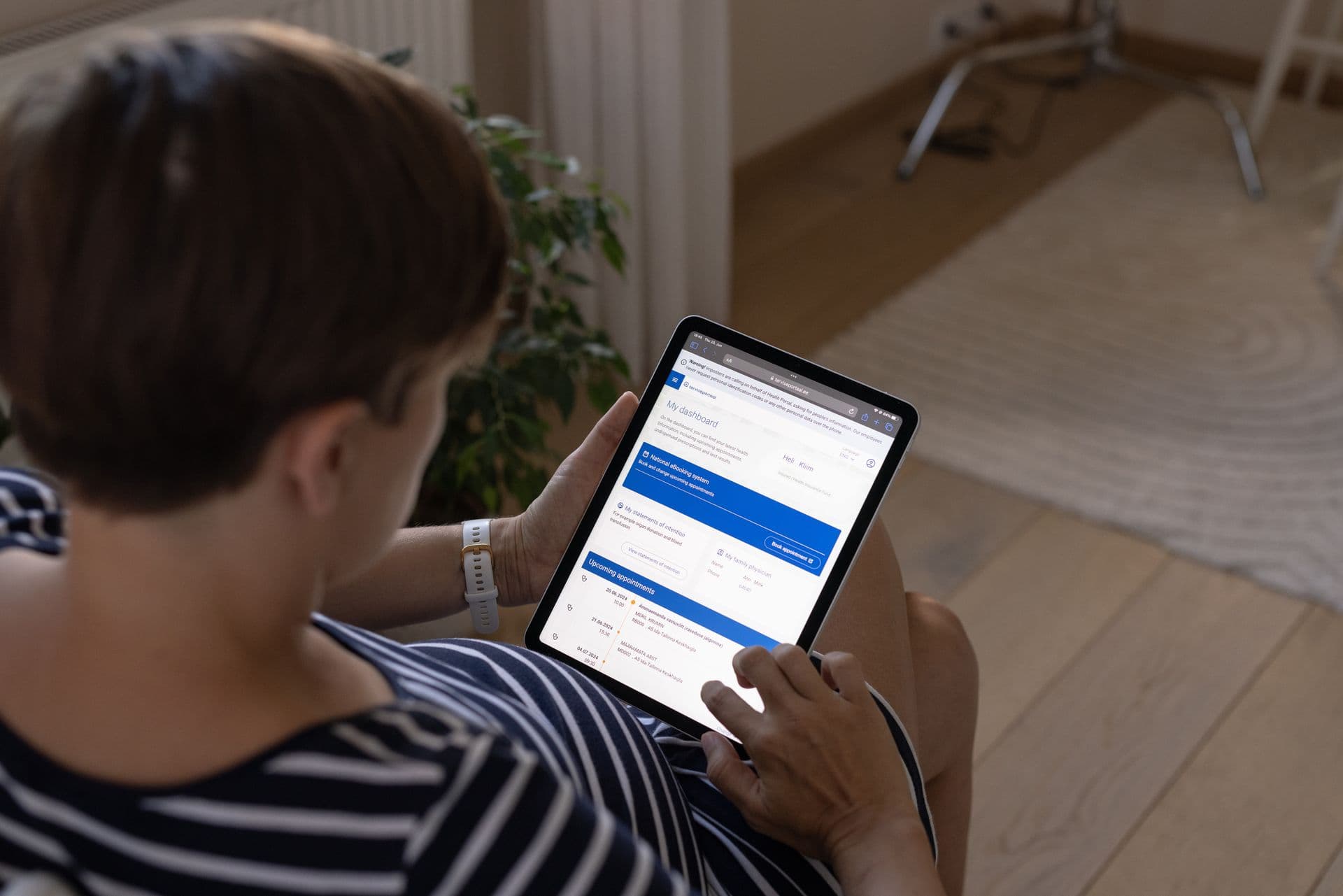

Why private health insurance is essential for location-independent entrepreneurs

How to get AWS credits as an e-resident company