where should i pay my taxes as a solopreneur?

If you’re starting out as a solopreneur, it’s worth considering the effects of your tax status on your earning potential.

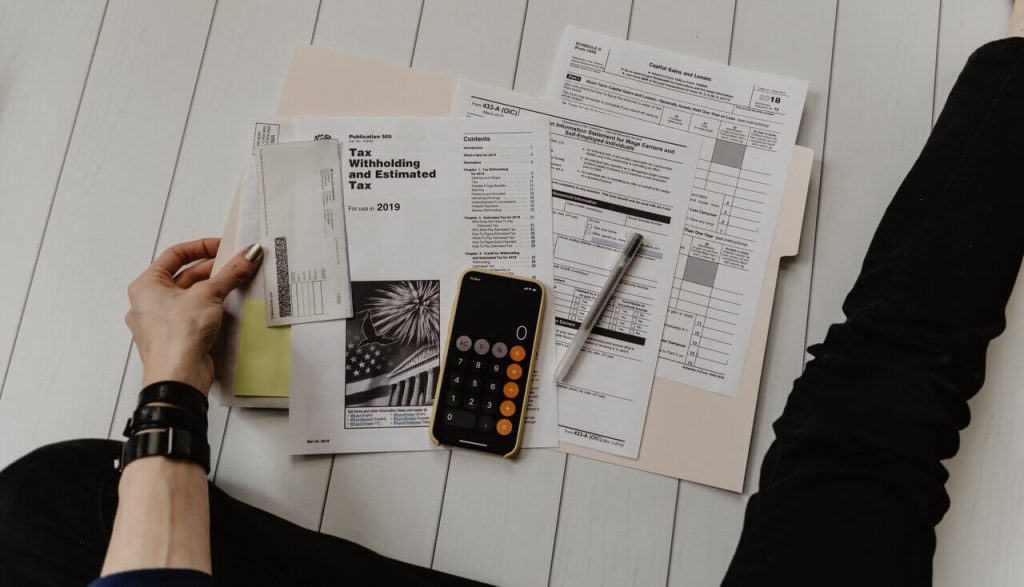

Business and personal taxes for solopreneurs

Regardless of whether you have established your solopreneurship business as a company or other legal entity, you may be liable for personal income tax.

For that reason, it’s important to consider the tax implications of being a self-employed solopreneur (compared with registering a business).

More from e-Residency

- Sign up for our newsletter

- Watch fresh video content - subscribe to our Youtube channel

- Meet our team and e-residents - register for our next Live Q&A