top 5 misconceptions about e-Residency

From tax avoidance to visa eligibility, let's bust the 5 most common myths about e-Residency

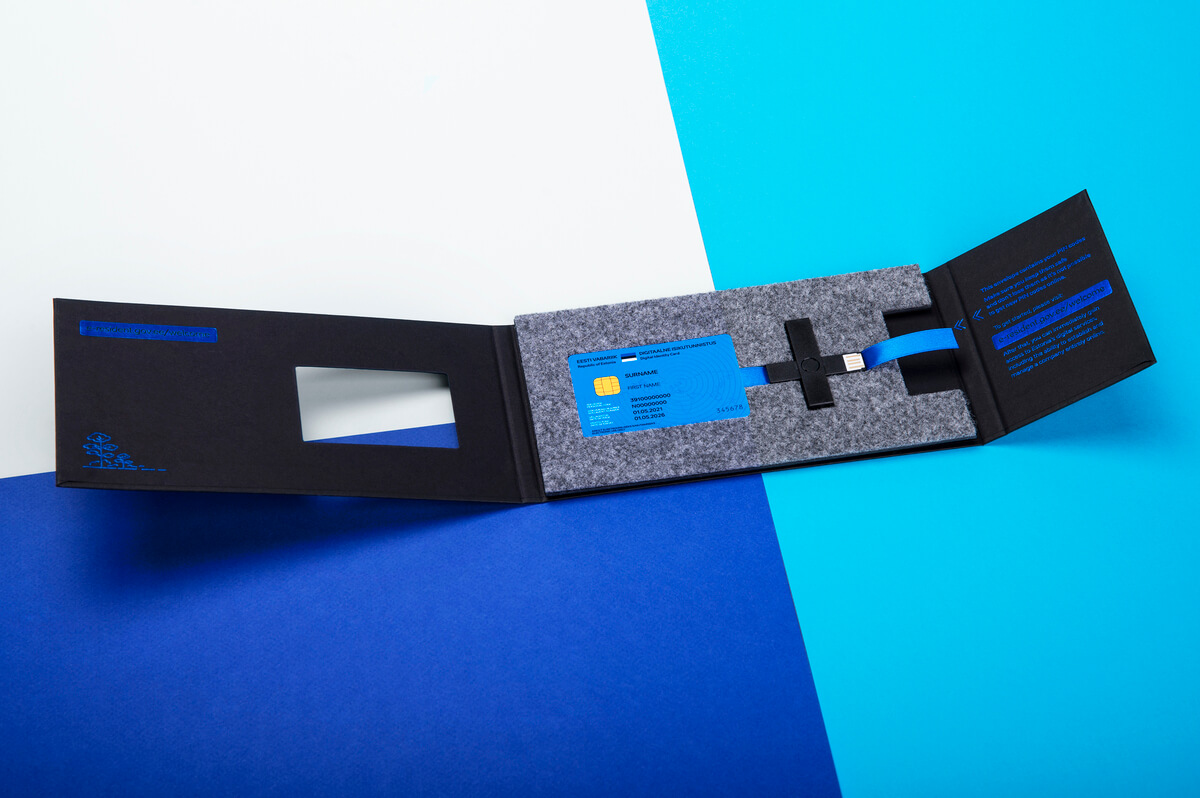

It has been 10 years since British journalist and then editor-in-chief of the Economist, Edward Lucas, received our iconic blue e-Residency card and thus became Estonia’s first e-resident. From the start, the program delivered an innovative premise of ease of doing business and open doors to the Estonian digital state to anyone from anywhere. Today, more than 120,000 e-residents and over 33,000 companies later, we can say the program has become a staple of entrepreneurship around the globe, with more than 170 countries represented amongst our e-residents.

Despite these numbers, our best efforts, and the sheer number of materials our content and customer support teams generate daily, we still come across some common misconceptions about our program among potential e-residents and entrepreneurs thinking about signing up. We have gathered this list with the top 5 common mistakes about e-Residency to address some of these misconceptions and hopefully answer some of your most pressing questions!

Without further ado, here are five of the most common misconceptions that users have about e-Residency:

1. e-Residency is a private company

This is most definitely NOT the case. E-Residency is a publicly-funded initiative of the Estonian government. It involves the work of multiple government agencies, such as:

- the Police and Border Guard (PBGB; the ones that actually process and print out the cards),

- the Ministry of Foreign Affairs (which very diligently supports our work by being our pick-up locations at Estonian Embassies around the world and mobile pickup locations),

- our colleagues at the Estonian Innovation Agency (which we are a part of and that help us promote in different stages and projects the benefits of e-Residency around the world), and

- many others that support our projects and efforts across the Estonian government.

From the get-go, e-Residency has always been managed as a government startup, giving us the flexibility and partial independence of action to pursue a proactive role in the Estonian startup ecosystem.

So, despite our youthful and hip looks with our green, blue, and pink hoodies, you must remember we are indeed civil servants, bringing some truth to the statement, "We are the government, and we are here to help."

2. Getting e-Residency is good for starting ANY type of company.

We understand that the ease of doing business in Estonia and the amazing public services are an enticing proposition for entrepreneurs and industrialists everywhere. But it is important to mention that while almost anyone can open a company in Estonia with an e-Residency, it doesn’t always make sense to do so.

Let me explain.

Yes, it is possible for many types of companies to be registered in Estonia. You can run them remotely and safely from anywhere in the world. However, you must consider how you will be paying the taxes and fulfilling the obligations that come with owning a company.

Take these two types of companies, at very different ends of the operating spectrum:

- a decentralised company that provides digital services to clients around the world, has employees working in different territories, and the founders are digital nomads working location independently, or

- a spork manufacturing enterprise based in the founder’s hometown in say Spain that sells mostly to local clients, and has their entire workforce based in the nearby area.

The first example is prime for being run out of Estonia with e-Residency. The company can be registered and managed on the go. Payroll could be managed by a distributed workforce service provider like Deel. And the company has a good operating structure to take advantage of Estonia’s tax system, which has been ranked the most competitive in the OECD for 11 years in a row.

The second example listed above might still be able to take advantage of many of the benefits of e-Residency, like the digital ease, growth opportunities, and supportive community. However, given that the company is almost completely operating locally in Spain, it’s likely that, tax-wise, it may not make sense to incorporate in Estonia. Not only would it add an additional layer of corporate tax administration, it would also be a headache for employing local staff and administering payroll.

This is why we always recommend getting help from our vetted group of service providers in the e-Residency Marketplace that can help you figure out if becoming an e-resident and starting a company in Estonia is a good match for you.

3. e-Residency can be an advantage when applying for a visa

This misconception goes along with another very common misconception that e-Residency somehow gives you some residency or travel rights to Estonia and, by extension, the European Union. However, this is not correct in either case.

E-Residency’s unique, government-issued digital identity allows people outside of Estonia to verify themselves securely online and digitally access diverse public and private Estonian e-services and the EU market from wherever they are in the world.

Being an e-resident provides no physical residency or travel rights to its holders, and as such, does not provide any type of advantage when applying for a visa or travel permit to Estonia.

Having said that, not all is lost, potential Estonian residents!

Estonia has different legal and accessible ways to become a temporary resident, such as the digital nomad visa and the startup and scale-up visas.

Let’s think of an imaginary entrepreneur, Monica. She has been an e-resident for 2 years and has been developing a new product that helps companies mind-read their customers. Clearly, a revolutionary idea, and scalable. Monica is also looking for growth and investment, and it is increasingly difficult to achieve this while still living in her native Bolivia. The difference in time zones does not help improve customer support as her team is still very small.

Monica knows about Estonia, she’s happy with how she can run her company, and would like to move there to help grow her business. She has two options to consider: first, apply for a digital nomad visa using her income from her own e-Residency company to validate her status as a potential digital nomad. This would allow her to come to Estonia on a temporary basis for up to one year with an opportunity to extend. This is a good option if she needs only some time here to get going, and get some investment procurement, but she intends to go back home when she has made some progress.

Here, you can find more information about Estonia’s Digital Nomad Visa vs E-Residency.

On the other hand, if Monica chose to stay in Estonia in the medium to long term, she could apply to register her company as a startup. She can apply online from her phone in about 10 minutes at Startup Estonia, get her code, and then apply for a Startup Visa. This way, she could move to Estonia and start growing her mind-reading company by connecting with investors, participating in accelerator programmes, and networking in Estonia’s flourishing startup ecosystem.

So, while e-Residency itself won’t give Monica any special benefit for a visa or immediate residency or travel rights, registering her startup in Estonia as an e-resident puts Monica on visa paths and gives opportunities to grow and scale her business.

Read more about growth opportunities with e-Residency:

4. In Estonia you don’t pay taxes/Estonia is a tax haven

It is true that the corporation tax works a little differently in Estonia. That, however, does not mean that you or your company won’t pay taxes. You’ll continue paying personal taxes in your country of tax residence.

And for your business? Well, you are probably used to your company paying proportional taxes from all the income it receives back in your own home country. In Estonia, we have a deferred corporation tax; this means that you only pay the tax once you decide to extract dividends from your company. Right now, this means 22% of the amount you decide to take in dividends.

The system gives new enterprises the breathing space that is necessary to grow. In a way, the Estonian Government becomes your non-equity partner for the first stage of your company until it becomes profitable enough to take your dividends out. This allows companies to invest in faster growth and use the first-stage funds to pay for services, employees, marketing, development, and many other things. Another important factor to mention is that this can be done indefinitely and that your company can invest its profits in different types of instruments as well.

Editor's Note (January 2025): Estonia has increased tax rates for companies and individuals from 1 January 2025. A security tax package has also been introduced, which will raise the VAT rate from 1 July 2025, raise the personal tax rate from 2026, and introduce a 2% profit tax from 2026. Read more about the changes.

You can find more information about Estonian taxation here:

5. You need to pay for your e-Residency card/registered company every year.

The e-Residency card is valid for 5 years. That means that once you apply and pay your state fee of €150, you won’t have to pay anything additional until it is time to renew.

There is a one time cost to register a company in Estonia of 265 EUR. This means once you register it, you will not have to pay any additional fee for the registration of the company. There could be, however, extra charges if you need to change shareholders or statutes for example. And there might be other expenses associated with registering a company in Estonia, such as procuring a legal contact point in Estonia.

But the e-Residency status itself only incurs a cost every five years when renewing your digital ID. This comes to 30 EUR a year and allows you to access the comprehensive digital ecosystem in Estonia and run your company from anywhere in the world 24/7. To put this into perspective, a basic web hosting plan runs around 160 EUR a year according to GoDaddy.

You can find more information about renewal here:

So there you have it, our top five most common misconceptions about the e-Residency program. Not to say that’s all clear and dandy, but here at e-Residency HQ we’ll continue to answer all your questions and bring you all the information and tools you need to succeed in your business (ad)venture!

Don’t forget you can reach us through our customer support channels, social media, and even some of our country specific advisors in the language landing pages!

More from e-Residency

- Sign up for our newsletter

- Watch fresh video content - subscribe to our Youtube channel

- Meet our team and e-residents - register for our next Live Q&A