setting up a company in dubai vs estonia

Setting up a company in Dubai is becoming a popular option for entrepreneurs. Here’s how it compares with setting up in Estonia.

Setting up a business in Dubai

Choose your business activity

Decide on the structure

You have the choice of a number of different business structures:

Request initial approval

For this you’ll request approval from the appropriate government department. They will ask for a number of documents including things like:

This stage costs AED 120 (~€27 or £24).

Register your company’s trade name

Request a trade licence and open a bank account

Now let’s dig into the details of the pros and cons of setting up a company in Dubai and Estonia.

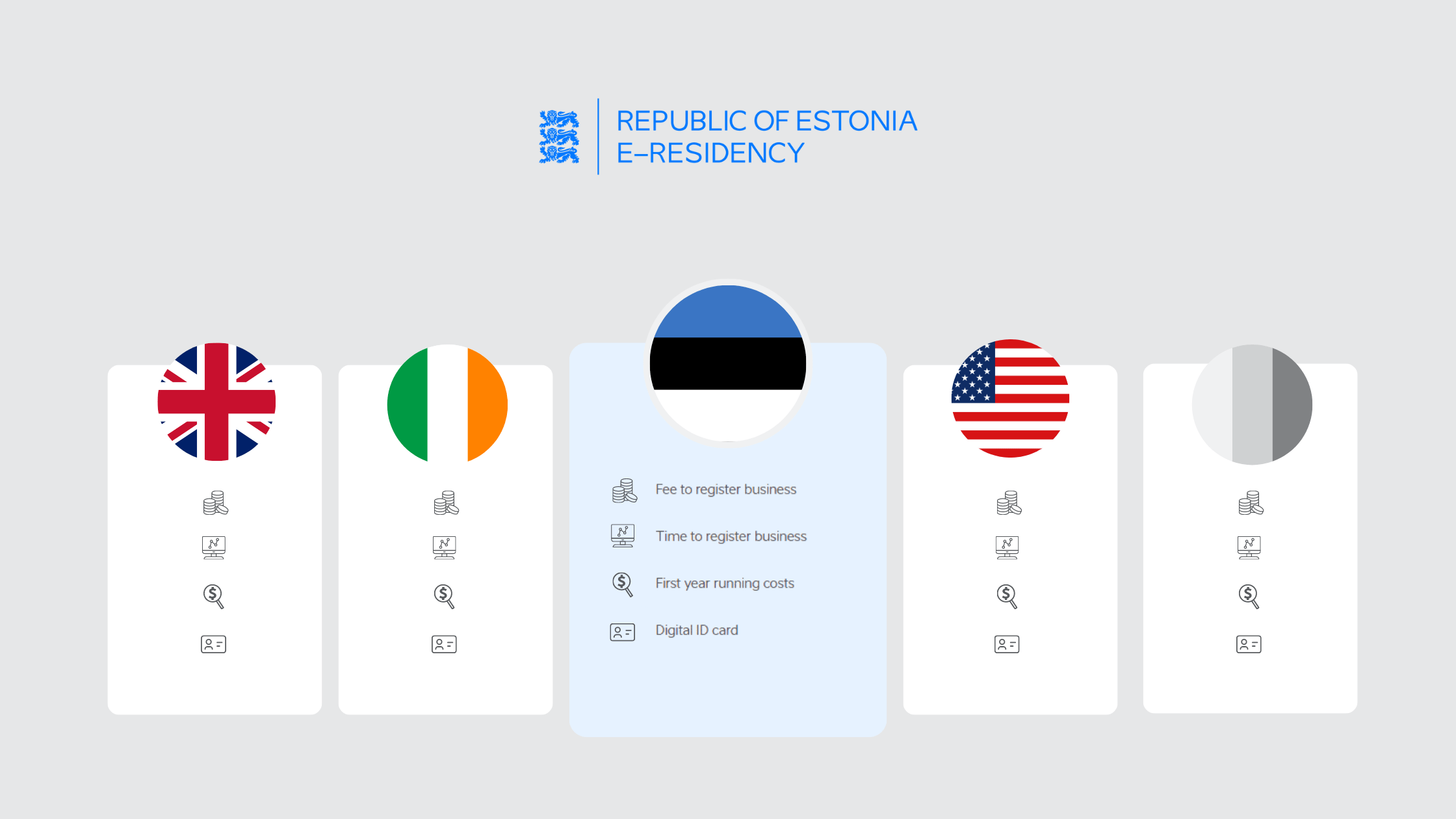

Company registration in Dubai vs Estonia

Company tax in Dubai vs Estonia

Comparing corporate tax

VAT

Income tax

Business bank account in Dubai vs Estonia

Why set up a business in Dubai?

Why set up a business in Estonia?

More from e-Residency

- Sign up for our newsletter

- Watch fresh video content - subscribe to our Youtube channel

- Meet our team and e-residents - register for our next Live Q&A